Low-Income Taxpayer

Clinic

The ECBA Volunteer Lawyers Project Low-Income Taxpayer Clinic (LITC) provides legal representation, advice, and referral services to low-income taxpayers who have disputes with the Internal Revenue Service (IRS) or cannot afford to pay Federal Income taxes that are owed.

LITC aims to ensure the fairness of the tax system by providing pro bono representation to low-income taxpayers with disputes with the IRS, as well as identifying issues impacting low-income taxpayers. Furthermore, the LITC regularly conducts tax education events on a wide range of tax issues to increase taxpayer understanding of their rights and responsibilities within the tax system. Please contact our office for more information.

Cases Handled

We can assist you at all stages of your case, including:

Appeals

Audits

Collections

Court Matters

The LITC can also assist with most Federal Income Tax issues, including:

Negotiation or Settlement of Tax Debt

Earned Income Tax Credit verification and denials

Dependency exemption and filing status

Injured/Innocent Spouse claims

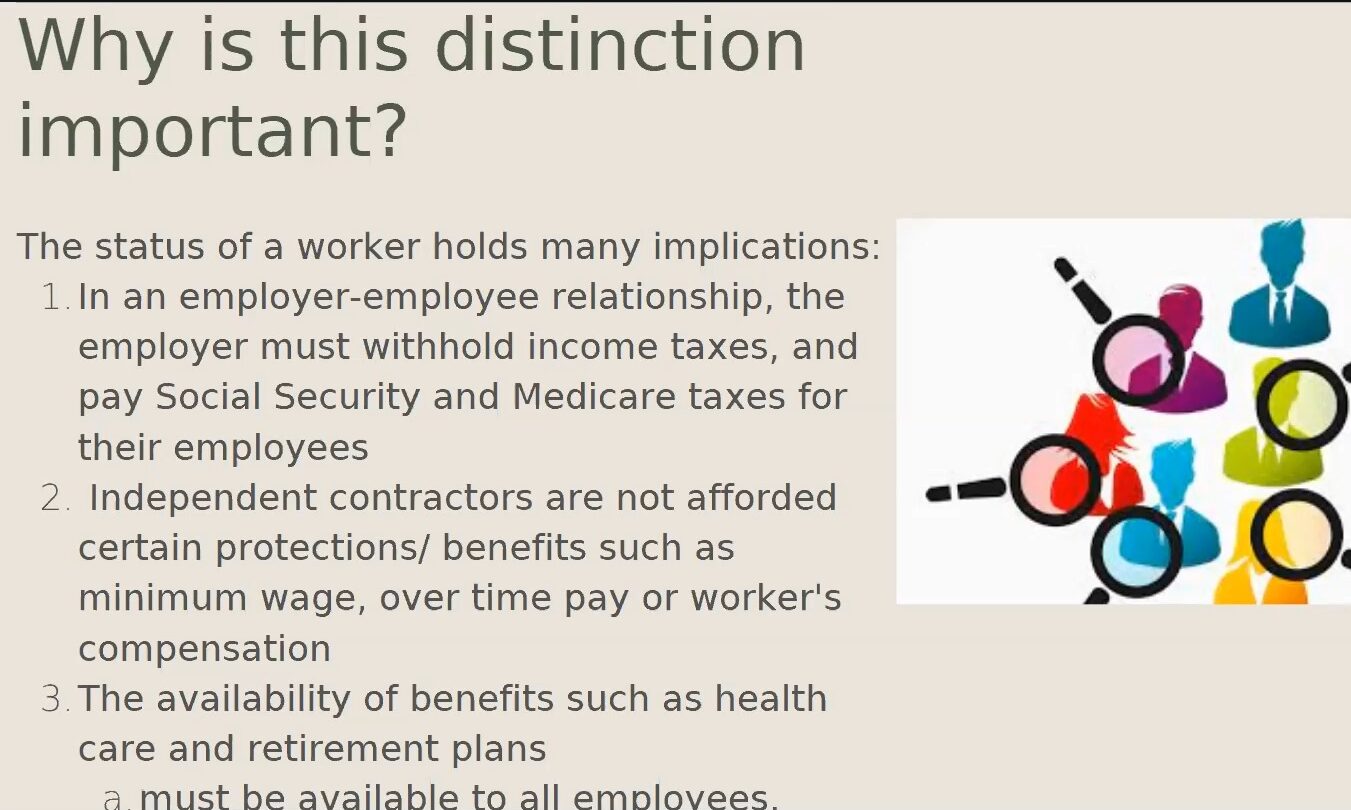

Worker classification (employee or independent contractor)

Levies and Liens

Identity Theft involving your tax return, income, or refund claims

PLEASE NOTE:

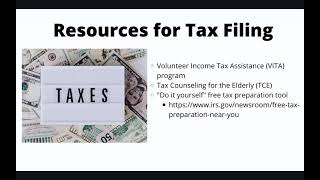

The LITC does NOT prepare client income tax returns – If you are in need of free tax preparation services, you can locate a Volunteer Income Tax Assistance (VITA) clinic near you through Free Tax Prep website.

Eligibility

Am I eligible?

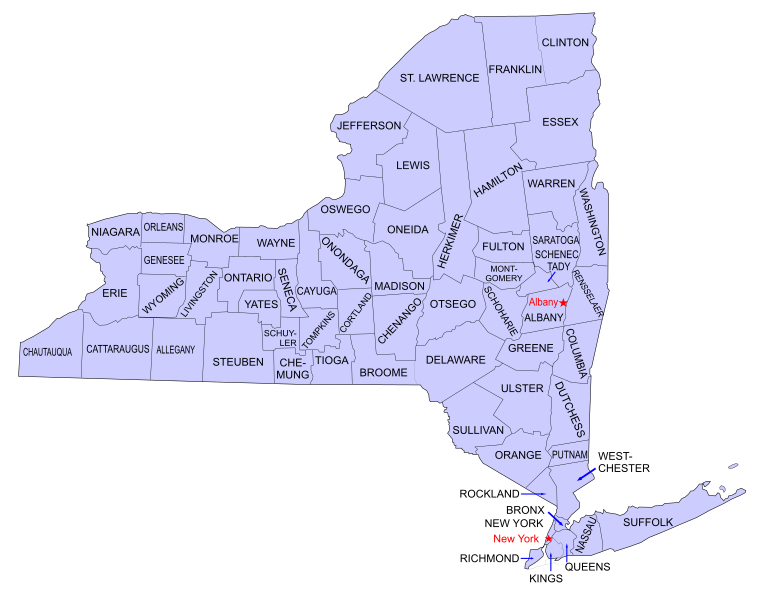

You are eligible for the LITC services from our office if: You are a resident of New York State and meet income and asset eligibility requirements.

Schedule Your Appointment

If you think you may be eligible, call (716) 847-0662 x 324 or our toll free number (800) 229-6198. Leave a message with your name, description of your tax problem, and a phone number where you can best be reached during normal business hours of 9:00 am and 5:00 pm Monday through Friday. A staff member will return your call as soon as possible.

Non English & Limited English speaking clients

If you are non English or limited English speaking, interpretation services can be arranged for you. PLEASE let us know while scheduling your appointment to ensure that an interpreter will be available.

You may also fill out our online intake form by clicking the link below.

Helpful Resources

Below you will find helpful resources that could answer certain tax related question you may have:

Know Your Rights – Taxpayer Rights (2/15/23)

Watch

Financial Wounds: How Domestic Violence Can Impact Your Taxes (1/18/23)

Watch

2022 Tax Filing Season Education Event (10/7/22)

Watch

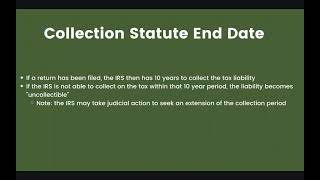

The Tax Collection Process (7/14/22)

Watch

Pay as You Go- A Guide to Withholding and Estimated Tax Payments (5/20/22)

Watch

Dependents (4/27/22)

Watch

Wage Earners vs Independent Contractors (4/25/22)

Watch

I Haven’t Filed My Taxes in Over a Year: What Can I Do? (4/25/22)

Watch

I have an IRS bill that I cannot pay. What are my options? (12/9/21)

Watch

ITINs: What Are They and Who Should Apply for One? (11/21/21)

Watch

I got a notice from the IRS: What do I do? (11/22/21)

Watch

Identity Theft and Taxes- What to do if your identity has been stolen (10/14/21)

Watch

What you need to know about the stimulus (9/13/21)

Watch

American Rescue Plan (9/13/21)

Watch

Collection Alternatives (4/2/21)

read more

Marriage and Taxes (4/2/21)

Watch

Tax Filing Basics (4/2/21)

Watch

Expanded Child Tax Credit (3/1/22)

read more

Questions about Economic Impact Payments? (11/1/20)

read more

Question about CARES ACT? (6/20/20)

read more

LITC Brochure (1/1/18)

read moreContact us

Get in touch

Address:

438 Main Street, 7th Floor, Buffalo, NY 14202

Phone:

(716) 847-0662 x 324 or (800) 229-6198